Mazur Appeal: A Defining Moment for Litigation Rights

The much-watched case of Mazur v Charles Russell Speechlys is now before the Court of Appeal and the stakes could not be higher.

At its core lies a fundamental question: Can legal executives and senior paralegals conduct litigation simply because they are employed within an authorised firm?

Last September, Mr Justice Sheldon held that they may not. His reasoning turned on the statutory framework for reserved legal activities. He concluded that the right to conduct litigation attaches to authorised individuals, not to firms in the abstract. Employment within an authorised practice does not, by itself, confer the right to carry out a reserved activity on someone who is not independently authorised.

The judgment emphasised regulatory clarity and individual accountability. If litigation is reserved, the person conducting it must personally hold the relevant authorisation. Non‑authorised team members can support the process, but the formal conduct of litigation must remain with an authorised individual.

For firms, the implications are considerable. Many operate leveraged models where legal executives and senior paralegals perform substantial litigation work under supervision. If the judgment stands, firms may need to restructure supervision frameworks, reallocate responsibilities, and increase authorised headcount.

We will continue to monitor developments closely and provide further updates as the appeal progresses.

What permission do I need to visit the UK?

Back in the day, the United Kingdom had a manual visa-free entry method for non-visa nationals, who simply had to physically appear at the UK Border and were allowed entry as a visitor for a period of up to 6 months. This changed in May 2023, when the UK Government introduced the Electronic Travel Authorisation (commonly known as ETA) to strengthen border security and digitise immigration.

The ETA is a digital permission to travel to the United Kingdom. It was first launched on the 25th of October 2023 for Qatari nationals, acting as the initial phase of a wider rollout and the first step toward the UK’s transition to the digital immigration system.

On the 1st of February 2024, the ETA was extended to other Gulf Cooperation Council States, namely, Bahrain, Jordan, Kuwait, Oman, Saudi Arabia and the UAE. On the 27th of November 2024, the ETA was opened for other non-European nationalities, including the USA, Canada, Australia and New Zealand.

The UK Electronic Travel Authorisation (ETA) scheme was opened to additional nationalities in March last year. Although European nationals were expected to begin applying from April 2025, the ETA did not become mandatory at that stage.

Mandatory enforcement will instead begin on 25 February 2026, at which point all eligible non-visa nationals travelling to the United Kingdom, including European nationals, must hold a valid ETA prior to travel.

An up-to-date list of eligible nationalities is available on the UK Government website: https://www.gov.uk/guidance/check-when-you-can-get-an-electronic-travel-authorisation-eta

At the time of writing, the ETA costs £16. The application process implies the submission of an application form, which can be done via the UK ETA app (available on Google Play and the App Store) or online. The process time varies from 1 to 3 working days, with further delays possible. More information about how to apply can be found here: https://www.gov.uk/eta/apply.

The ETA is valid for 2 years or until the passport, which was used during the application process, expires, whichever is sooner.

The carriers can deny boarding to anyone who requires an ETA but does not have one.

What if I am a visa national?

For visa nationals, the process of acquiring the right to enter the UK as a visitor involves a submission of a visa application and attendance at a designated Visa Application Centre, often in a country of residence, to submit biometric data.

As part of the UK’s wider transition to a fully digital border, physical entry clearance vignettes are being phased out in favour of eVisas, which are digitally linked to a traveller’s passport. While the exact date on which all visa nationals will move entirely to eVisas has not been formally confirmed, it is clear that from 25 February 2026, all travellers to the UK will be required to hold either a valid ETA or an eVisa linked digitally to their passport.

Essentially, an eVisa is a digital record of UK immigration status containing conditions of stay. Upon a successful visitor visa application, the applicant will be given instructions on how to create a UKVI account and how to demonstrate a valid permission to enter the UK to the carriers and at the UK border.

British dual nationals

This cohort of travellers does not require an ETA or eVisa. They can travel on a valid British passport or a passport endorsed with a Certificate of Entitlement (CoE). On the 26th of February 2026, the CoE vignettes will be replaced by a digital CoE and will not require renewal when a passport expires. Instead, the CoE holders will be able to update passport details via their UKVI account for free.

Other travellers

Certain individuals do not require an ETA or eVisa because they are exempt from the UK Immigration control. From the 25th of February 2026, this group of travellers will receive a Digital Record of Exemption, which will replace a physical exempt vignette in a passport.

The holders of Home Office Travel Documents, such as Commonwealth citizens and foreign nationals (often refugees), as of the 26th of February 2026, will be able to automatically link their status to the UKVI account.

Do I need a lawyer to assist with ETA and eVisa?

When applying to visit the UK, visa nationals (eVisa applicants) and non-visa nationals (ETA applicants) must meet the relevant Immigration requirements, which, at the time of writing, are set out in Appendix V: Visitor of the Immigration Rules.

For most applicants, the visa application process is usually straightforward and does not require legal assistance. However, applicants with a past or present criminal records, offences, and visa refusals, or activists should seek legal advice on eligibility under the Immigration Rules, to avoid disappointment of receiving a refusal.

At Chan Neill Solicitors LLP, we have decades of experience in assisting a wide range of travellers to the United Kingdom. Do not hesitate to contact our Immigration Team for advice and assistance.

This article is provided for general information only. It is not intended to be and cannot be relied upon as legal advice or otherwise. If you would like to discuss any of the matters covered in this article, please contact us using the contact form or email us on reception@cnsolicitors.com

Ground Rent Reform

What the £250 Cap Means for Leaseholders and Investors

Last year, the Government signalled its intention to reform the leasehold system as part of its wider housing and cost-of-living agenda. In January 2026, that intention took a concrete step forward.

On 27 January 2026, the Government published the draft Commonhold and Leasehold Reform Bill (the Bill) for pre-legislative scrutiny, describing it as a key measure in its manifesto commitment to bring the “feudal leasehold system to an end” in England and Wales.

A central feature of the Bill is the reform of ground rent payable under existing long residential leases.

What is changing: the £250 ground rent cap

Under the proposals:

- Ground rents on existing long residential leases will be capped at £250 per annum

- The cap will apply for a 40-year transitional period

- After 40 years, ground rent will be reduced to a peppercorn (effectively £0)

This reform extends the protections introduced by the Leasehold Reform (Ground Rent) Act 2022, which abolished ground rents for most new residential leases, to leases granted before 2022.

The stated policy objective is to end leaseholders paying “over-the-top bills for no clear service in return”, while addressing the saleability and mortgage ability issues associated with escalating or uncapped ground rent clauses.

The Government estimates that some leaseholders could save more thousands over the life of their lease, and that the reform will help unlock stalled property sales where ground rent terms have made homes difficult to sell or refinance.

Why the ground rent cap is significant

Ground rent has long been a routine feature of residential leases, often payable without any corresponding service and, in some cases, subject to escalating clauses that significantly increase costs over time.

By introducing a statutory cap and a long-term transition to a peppercorn rent, the proposed reform marks a clear shift in how ground rent is treated within the leasehold system. It is intended to reduce financial pressure on leaseholders while addressing wider market issues, including saleability and mortgage lender concerns, by improving certainty and confidence in the residential property market.

Ground rent reform is also intended to address market dysfunction, particularly:

- Flats rendered unsellable due to onerous ground rent clauses

- Mortgage lender reluctance to lend on leases with escalating rents

- Leaseholders trapped in properties with diminishing marketability

How we can help

Chan Neill Solicitors LLP has an experienced residential conveyancing team advising on both leasehold and freehold transactions. We regularly assist clients in navigating regulatory change and its practical impact on property transactions and investment decisions.

What’s next?

In our next article, we will look beyond ground rent and explore other proposed reforms under the Renters’ Rights Act 2025, examining how they may affect landlords, tenants, and the residential property market more broadly.

Litigation Essay Competition 2026

Here at Chan Neill Solicitors, we are committed to delivering high-quality legal expertise, providing client-focused services tailored to businesses and individuals alike. We pride ourselves on providing strategic guidance and well-considered advice whilst protecting our clients’ interests. Our team of skilled legal professionals strive to become their clients’ trusted advisors in all aspects of their clients lives and businesses, working to help clients navigate complex legal challenges, fostering trust and long-term relationships.

We are, therefore, pleased to announce our inaugural Litigation Essay Competition! We are looking to foster debate, critical thinking, and practical writing abilities in law students and legal professionals at the very start of their career. Entries will be judged on the quality of their legal research, understanding of statute and case-law, and their ability to set out and defend it.

Please select from one of the following questions:

- Part 36 offers of settlement serve the purpose of ensuring parties to litigation seriously consider settlement. However, to what extent can Part 36 settlement offers be strategically misused and/or abused, and how?

- The use of AI has become increasingly common in everyday life. To what extent should litigants make use of AI, and what are the potential pitfalls of doing so?

- The “Mazur decision” has sent shockwaves throughout the litigation market. What areas within the litigation sphere have been most impacted, and what steps should be taken to ensure compliance?

- “Ignorance is not a defence”. To what extent does this fundamental legal principle still hold true?

This opportunity is open to undergraduates, post and recent graduates without a training contract or pupillage.

In addition to your essay submission, please write 50 words outlining what stage you are at in your studies and that you do not yet have a pupillage or training contract. Please also confirm that you have not used Artificial Intelligence.

Rules

- Essays must be no more than 1,500 words (excluding footnotes).

- Answers should be sent to tboyton@cnsolicitors.com in Microsoft Word format. The covering email should state the entrant’s full name, present (or most recent) university/college and contact details (judging is anonymous). All submissions will be acknowledged.

- Any submissions found to be AI led will be immediately disqualified

- This opportunity is open exclusively to those in the UK.

- The deadline to submit is Monday, 2nd March 2026

Each essay is judged against the following criteria:

1. Legal and case analysis;

2. Structure; and

3. Legal writing style.

HOW THE COMPETITION IS JUDGED

Essays are judged in two stages:

- In the first instance, members of the Litigation Team will review all entries to select a shortlist.

- At the second stage, the prize-winners are decided by the Head of Litigation.

REWARD

The top prizes for the competition are as follows:

Winner – Two week Vacation Scheme and a 1-1 discussion on work with Litigation Head ·

Runner Up – One week Vacation Scheme

The winning essays will also be published on the Chan Neill Solicitors LLP website.

Acting Within Powers: Why Your Company’s Rulebook Matters

The Directors’ Duties Series – Part 1

When Annie joined the board of a growing fintech start-up, she didn’t think much about the company’s Articles of Association. After all, wasn’t that just “boilerplate” paperwork filed years ago?

That assumption cost her.

Months later, Annie approved a new share issue to an investor - a move later challenged by other shareholders. The problem? The Articles required both board approval and a special shareholder resolution, which she hadn’t obtained.

The court found she had acted outside her powers under section 171 of the Companies Act 2006. The share issue was set aside, and Annie faced a claim by the company for breach of duty.

What Does Section 171 Require?

Directors must:

- Act in accordance with the company’s constitution, which includes the Articles of Association and certain formal resolutions, and may also operate alongside other governance documents such as shareholders’ agreements; and

- Only exercise their powers for the purposes for which those powers were conferred.

It sounds straightforward, yet this duty is frequently overlooked, particularly in fast-moving companies where “commercial urgency” tends to trump formalities. But failing to check your authority before taking key decisions can unravel months of work, create shareholder disputes, and expose directors personally to claims.

How to Stay Compliant

- Know your rulebook - Regularly check your company’s constitution before important decisions: issuing shares, signing material contracts, restructuring the company, approving major transactions, or any action that might require shareholder consent.

- Document your authority - Ensure that minutes and resolutions clearly record board decisions.

- Seek early advice - If you’re unsure, take legal guidance before acting, particularly where the Articles or shareholders’ agreements contain bespoke provisions. It is far easier to confirm authority than to unwind an unauthorised decision.

Directors who understand where their powers begin and end not only protect themselves, they build credibility and trust in the boardroom.

How We Can Help

At Chan Neill Solicitors LLP, we regularly advise company directors, boards, and shareholders on governance, compliance, and risk management under UK company law and related legislation.

If you are uncertain about the scope of your powers or other obligations as a director, or wish to review your company’s governance framework, Articles, board procedures, shareholders’ agreements, or compliance processes, our corporate team can advise on practical steps to ensure you meet your duties and manage risk effectively.

Get in touch with us to discuss how we can help you and your business.

Next in the series:

Promoting the Success of the Company (s.172) - balancing the company’s success with wider stakeholder interests.

Disclaimer:

This publication is intended for general information purposes only and does not constitute legal or professional advice. You should not act upon the information contained in this article without obtaining specific legal advice. Chan Neill Solicitors LLP accepts no responsibility for any loss which may arise from reliance on information contained herein.

Sponsorship License Compliance visit – top tips

According to the UK Visa & Immigration Transparency Data, by Q3 of 2025, there were 127,859 licensed sponsors under the Skilled Worker, Student and Temporary Worker routes, which is 3.8 times more organisations that can sponsor migrant workers than in Q4 of 2019 (pre-Brexit).

The Transparency Data provides insight into the number of new sponsor applications submitted each quarter, but is unhelpfully silent on the refusal percentage of the submitted applications.

What is revealed is the number of suspended and revoked Sponsorship Licenses. For example, in Q3 of 2025, there were 608 Licenses suspended and 541 revoked, which is a staggering increase from 2 suspended and 2 revoked Licenses in Q3 of 2021.

Our Experience with Sponsor Licence Compliance Visits

At Chan Neill Solicitors, we have been assisting Licensed Sponsors for many years. We cannot help but notice an increase in the Home Office Compliance visits and Skilled Worker Interviews in recent months. Given the number of revocations and suspensions, as well as the measures that have been and yet to be implemented by the UK Government aimed at the reduction of net migration, the Home Office’s tougher approach is apparent, and the Sponsoring organisations should take their duties and obligations as ever seriously.

This article is primarily aimed at assisting existing License holders with the preparation for the Home Office Compliance visit, but can also serve as a reference point to the prospective sponsors in the preparation for their Pre-License Compliance visits.

There have been reports that the Home Office is moving towards Digital Compliance visits, which are conducted remotely via digital platforms such as MS Teams. While Digital inspections are currently more common in Skilled Worker visa application interviews, in our experience, for Sponsorship License Compliance visits, in-person checks remain the standard practice.

The visit usually lasts 2-3 hours, during which time a series of questions are asked about the company’s nature of business, operations and current CoS allocation, practices used to monitor immigration status and preventing illegal working, maintaining worker contact details, record keeping and recruitment practices, migrant tracking and monitoring, as well as about general sponsor duties.

In particular, the Licensed sponsor must be ready for the following line of questioning and have all the necessary documents prepared for the visit. Note: the interviewee is the company’s Authorising Officer as mentioned on the License.

General Information:

- Full name, date of birth and nationality of the interviewee.

- Interviewee’s position within the organisation.

- Company’s incorporation date.

- Information about current Directors and Shareholders.

- Company’s name and the nature of the business.

- Business address.

- Company’s operational hours.

- Company’s official website.

- Current CoS allocation limit and justification for the current undefined CoS allocation.

- Email address that is accessible by the Authorising Officer.

- Who submitted the Sponsorship License application?

- How members of staff are being paid.

- Tip: Prepare to provide the company’s business bank statements and employees’ payslips.

- What is the company’s pension scheme?

- Has the company requested a refund of a CoS and Immigration Skills Charge from a sponsored worker?

- What funds does the company have available to fund employees’ salaries?

- Tip: Prepare to provide the current contract for services, invoices and other relevant documents.

Monitoring immigration status and preventing illegal working:

- How many members of staff are currently employed, and an explanation of their roles.

- Number of migrant workers employed.

- Procedure used to conduct a right-to-work check.

- Tip: Prepare to present each worker’s valid passport and eVisa (or other form of permission).

- How expiry dates of passports/visas are monitored.

- Tip: Prepare to demonstrate the system currently in place.

Maintaining Worker Contact Details:

- What HR system is currently in place?

- System used to monitor contact details (historical data).

- Tip: Prepare to demonstrate the system currently in place.

- How the changes are recorded.

Record Keeping & Recruitment Practices:

-

- Tip: Prepare to provide the company’s up-to-date hierarchy chart.

- What vacancies are available?

- Tip: For employees that require sponsorship, prepare to provide information about job title, SOS Code, salary and weekly working hours.

- What are the company’s recruitment practices?

- Tip: Prepare to demonstrate past and present job advertisements.

- Tip: Prepare to demonstrate CVs and Interview Notes for all candidates who have applied for a job for which a migrant worker was identified.

- Tip: Be prepared to provide an explanation why each candidate was suitable/not suitable for the role on offer.

- Tip: Prepare to provide employment contracts for current employees and a job description for prospective employees.

Migrant Tracking & Monitoring:

- The company’s policies regarding annual leave and how annual leave is requested.

- How the employees’ attendance is monitored.

The questions may have different phrasing, but maintain the underlying purpose of inspecting the compliance with duties and obligations as a Licensed sponsor.

Upon the conclusion of the interview, the interviewee has an opportunity to review the Compliance Officer’s written notes and request corrections if necessary. The interview notes are then passed onto the case working team who makes the final decision.

- Final tip: The interview notes must be read thoroughly before signing to check for any incorrectly recorded information.

To stand the best chance at a successful interview, at Chan Neill Solicitors LLP, we offer Licensed Sponsors service to prepare them for the Compliance Visit, including a mock interview and review of the company’s practices and documents. Do not hesitate to contact our Immigration Team for more information.

This article is provided for general information only. It is not intended to be and cannot be relied upon as legal advice or otherwise. If you would like to discuss any of the matters covered in this article, please contact us using the contact form or email us on reception@cnsolicitors.com

Mansion Tax: Assessing the Impact on Homeowners and Rural Businesses

Mansion Tax: Assessing the Impact on Homeowners and Rural Businesses

What Is the “Mansion Tax”?

Announced in the 2025 UK Budget, the new High Value Council Tax Surcharge (HVCTS), more commonly known as the "mansion tax," is a proposed levy on residential properties valued at £2 million or more. Introduced by Chancellor Rachel Reeves, the surcharge is designed to increase the contribution from owners of high-value homes and is expected to come into effect in April 2028.

Homeowners affected by this policy will face a new annual charge on top of their regular council tax, with rates tiered according to the property’s market value, assessed in 2026. The proposed rates are:

- £2.0–2.5 million: £2,500 per year

- £2.5–3.5 million: £3,500

- £3.5–5.0 million: £5,000

- Over £5 million: £7,500

How the £2 Million Threshold Affects London Homeowners

The government estimates that the tax will affect around 145,000 - 165,000 (around 0.4%–0.5% of properties) homeowners across England only. The term mansion implies that these are lavish properties owned by the ultra wealthy. However, in reality, many homes caught by the £2 million threshold are far from grand estates, especially in some part of London, such as Richmond, Pimlico, or Esher. In these neighborhoods, £2 million might buy a three bedroom terrace or a modest semi detached family home, not a mansion by any traditional standard.

Many homeowners who bought decades ago, before London’s property boom, now face unexpected tax bills due to rising valuations. In areas like Richmond or Pimlico, an average sized home may be taxed the same as a luxury estate elsewhere.

Assessing the Mansion Tax’s Impact on Agricultural and Business Properties

Another significant concern relates to the impact on rural landowners and farmers. Many farms include large residential properties, but these are often tied directly to the functioning of the business, not used as luxury dwellings. Farmers argue that taxing these homes as if they were mansions ignores the economic realities of running a working agricultural operation.

Recent changes to inheritance tax rules have capped full agricultural and business property relief at £1 million per person, with only partial relief above that, which could still increase the exposure of larger farms to inheritance tax.

Legal and Practical Uncertainty

The mansion tax raises significant legal and practical concerns, particularly for properties used in business, such as farms, where exemptions remain unclear. With valuations overseen by the Valuation Office Agency, questions around fairness and consistency persist, and no detailed guidance has been issued. A transparent valuation framework and accessible appeals process are essential. Most importantly, the policy’s aim should be clarified, whether it is to tax wealth or to generate revenue, so it does not unfairly burden families or businesses simply due to rising property values.

Supporters of the surcharge argue that it corrects longstanding unfairness in the council tax system, where some multi‑million‑pound homes contribute less each year than far more modest properties in other parts of the country. At a headline level, this appears to make the system fairer and ensures that owners of the most expensive homes contribute more to local services. However, this broad‑brush approach risks penalising ordinary households and working farms that happen to sit on highly valued land, rather than targeting genuinely discretionary wealth or speculative property holdings.

The mansion tax risks capturing ordinary homeowners and working farms, rather than targeting genuine luxury properties. To avoid placing unintended financial pressure on those simply living or operating in high-value areas, the government should revise the policy to reflect real-world property use and values, striking a balance between fairness, clarity, and effectiveness

Earned settlement – what we know so far?

The UK Government’s intention to introduce changes to the standard qualifying period for permanent residence (also known as indefinite leave to remain or settlement) was first heard of in the 12th of May 2025’s White Paper.

On the 20th November 2025, the Home Office published a statement and accompanying consultation on earned settlement, which shed light on what the new earned settlement rules may look like. The consultation is now open until 11.59 pm on the 12th of February 2026, and the changes are expected to start being implemented in the April 2026 Statement of Changes.

Most welcome news is that the spouses and dependents of British Citizens and British Nationals (Overseas) Citizens on Hong Kong route will be unaffected by the proposed changes. Note that parents in the ten-year route may still be caught by the reform. The other unaffected groups are those under the EU Settlement Scheme, Windrush Scheme and HM Armed Forces.

The most distressing news is that there may be no transitional arrangements for those currently in the UK on a route to settlement. Those who may be affected by the reform should participate in the consultation (link is below) and “strongly disagree” with the question To what extent do you agree or disagree that there should not be transitional arrangements for those already on a pathway to settlement?

The gist of the change is to grant settlement on the basis of contribution to the UK rather than after a fixed period. Earned settlement is to be based on a “time adjustment” model built on four core pillars: character, integration, contribution and residence.

The default qualifying period (also called the baseline) will be 10 years, with the exception of certain groups or individuals and 20 years for those recognised as refugees. There will be three mandatory requirements when applying for settlement, namely:

Suitability:

- Requirements in Part Suitability must be met

- No current litigation, NHS, tax or other government debt

Integration:

- English Language Requirement – level B2

- Life in the UK test

Contribution:

Annual earnings above £12,570 for a minimum of 3 to 5 years, in line with the current thresholds for paying income tax and National Insurance Contributions (NICs), or an alternative amount of income

If the mandatory requirements are met, considerations will be given to the baseline period, which can be adjusted upwards or downwards.

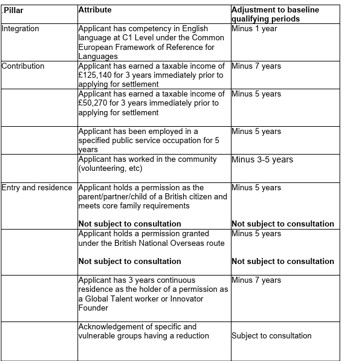

The table below sets out the proposed considerations that will reduce the baseline period:

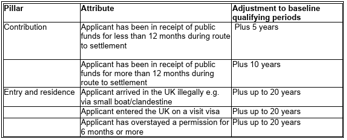

The following considerations will increase the baseline period:

The other proposed changes are:

- The qualifying period for settlement of adult dependents of economic migrants will be separately determined based on their own attributes and circumstances.

- Minor children of economic migrants will be eligible to be granted settlement in line with their parents.

- A cut-off point linked to the age of dependent children may be introduced to transition to an immigration pathway and progress to settlement in their own rights.

- The Long Residence route will be scrapped.

- An increase in the baseline qualifying period to 15 years for those in the Skilled Worker route in a role below RQF level 6 (equivalent to a bachelor’s degree).

To reiterate, the above is subject to a consultation, and anyone who is interested should take part: https://ukhomeoffice.qualtrics.com/jfe/form/SV_1yMmiaG7zqwPuM6

This article is provided for general information only. It is not intended to be and cannot be relied upon as legal advice or otherwise. If you would like to discuss any of the matters covered in this article, please contact us using the contact form or email us on reception@cnsolicitors.com

Responding to Court Proceedings

Before You Respond

Before responding to the claim, the defendant should check whether the claimant sent a Letter Before Action or complied with any applicable Pre-Action Protocol. Under the Civil Procedure Rules, claimants are expected to give advance notice of a claim and attempt to resolve matters before issuing proceedings. If no such letter was sent, or if the claimant failed to comply with the relevant pre-action requirements, the defendant may raise this non-compliance with the court. This could affect case management decisions or result in cost penalties being imposed on the claimant later in the proceedings.

What Does Being “Served” Mean?

Getting served with court proceedings can be confusing and stressful, but how you respond is critical. If you have been served with English Court proceedings, this means that someone has filed a legal case against you in the courts of England and Wales.

The English courts have strict procedural rules that defendants must follow. Failing to comply with these rules can seriously damage your position, and may even lead to a judgment being entered against you before you have a chance to present your defence.

The documents served on you will typically include:

- The Claim Form: which sets out key information about the claim, including the names of the parties and the remedy sought from the court.

- The Particulars of Claim (PoC): which provides a detailed account of the legal and factual basis of the claim, including background, allegations, and legal arguments.

What Should I Do?

The deadline for responding to an English claim is calculated from the deemed date of service of the Particulars of Claim. Under the Civil Procedure Rules, the deemed date depends on the method of service. For example:

- Service by first class post is deemed to occur two business days after posting;

- Service by email is deemed on the next business day, if sent before 4:30 p.m.;

- Personal delivery is deemed on the same day, if completed before 4:30 p.m.

Although the Particulars of Claim are often served together with the claim form, this is not a requirement. The claimant may serve them separately, up to 14 days after the claim form has been served.

Acknowledgment of Service and Defence

Once the Particulars of Claim have been served, the defendant has 14 days (from the deemed date of service) to respond by filing an Acknowledgment of Service. This is a formal notice to the court and the claimant confirming that the defendant has received the claim and setting out how they intend to proceed. Specifically, the defendant must indicate whether they:

- Intend to defend the claim;

- Admit the claim in whole or in part; or

- Challenge the jurisdiction of the court.

Filing the Acknowledgment of Service extends the deadline to submit a Defence by an additional 14 days, providing a total of 28 days from the deemed date of service of the Particulars of Claim.

The Defence is a separate and more detailed court document. In it, the defendant must respond directly to the allegations made in the Particulars of Claim. This involves replying to each numbered paragraph, stating whether the allegation is:

- Admitted;

- Denied, with reasons provided; or

- Not admitted, with an explanation (such as a lack of knowledge or information).

The Defence should also include any relevant factual background, legal arguments, and, if appropriate, a Counterclaim.

Why You Must Not Ignore the Claim

Even if you believe the claim is unfounded, you must not ignore it. Doing nothing may result in the claimant applying for a default judgment, where the court finds against you simply because you failed to respond within the required timeframe.

Do I Need a Solicitor?

While it is possible for a defendant to respond to the court directly, it is strongly recommended that you seek advice from an experienced litigation solicitor. Civil litigation can be legally and procedurally complex. Mistakes made early in the process, such as missing a deadline or failing to plead your case properly can be difficult or impossible to correct later.

How We Can Help

At Chan Neill Solicitors LLP, we have deep experience handling all stages of litigation. Our team is highly familiar with court procedure and can support you from the initial claim through to response, preparation, negotiation, and final resolution. We provide clear, strategic advice tailored to your circumstances and work to protect your position at every stage of the process.

What to expect from the Home Office during the Skilled Worker interview

With the increase in the number of Licensed sponsors and subsequently in the number of work visa applications, the Home Office interviews became more common.

The purpose of the interview is to assess the applicant’s eligibility for the role on offer, including their education, relevant qualifications and work experience and that the role that the applicant is being sponsored to do genuinely exists, not s sham and has not been created mainly to gain entry to the United Kingdom.

For the entry clearance application, the Home Office interview is conducted virtually, with the applicant being seated in front of a computer at the VAC in the country of nationality. The legal representative can be present and provided with a link to the conference call upon request. The interpreter can be requested if the applicant prefers to be interviewed in their native language.

In this article, we would like to list the questions for a Full Stack Software Developer role:

- Q1: The applicant is asked to confirm their full name, date of birth and nationality;

- Q2: The applicant is asked whether they hear the interviewer clearly and can understand what is being said;

- Q3: The applicant is asked whether they are happy with the interview being recorded;

- Q4: The applicant is asked whether they are fit and well enough to be interviewed;

- Q5: The applicant is asked to answer questions slowly and clearly because the questions and answers are being typed;

- Q6: The applicant is informed that they can ask for the questions to be repeated or rephrased;

- Q7: The applicant is asked not to take pictures, and whether anyone was with them in the interview room;

- Q8: The applicant is asked not to speak to anyone during the interview, including their legal representative. The legal representative can comment at the end of the interview;

- Q9: The applicant is asked whether anyone assisted them with the documents for the visa application;

- Q10: The applicant is asked whether they want to provide any information they forgot to include in their application;

- Q11: The applicant is asked whether their Sponsor asked them to pay any fees;

- Q12: The applicant is asked what relevant training or education they have to take on the sponsored role;

- Q13: The applicant is asked to provide details of the sponsor in the UK, including their name, office address and the nature of business;

- Q14: The applicant is asked to name a line manager for the sponsored role;

- Q15: The applicant is asked to provide job duties on a day-to-day basis;

- Q16: The applicant is asked to clarify why they were chosen for the role;

- Q17: The applicant is asked what are key considerations are when designing a scalable system;

- Q18: The applicant is asked to define “arise”;

- Q19: The applicant is asked how they approach debugging;

- Q20: The applicant is asked how they write code that is sustainable and reusable;

- Q21: The applicant is asked to define “Test-driven development”;

- Q22: The applicant is asked to define “Integrated development environment”;

- Q23: The applicant is asked what a computer programmer does;

- Q24: The applicant is asked what programming language they use in their work;

- Q25: The applicant is asked to define “Agile methodology”;

- Q26: The applicant is asked what Front End and Back End mean in relation to programming;

- Q27: The applicant is asked what considerations should be made to ensure a functional and responsible interface;

- Q28: The applicant is asked when the code is clear and testable, and when it is badly written;

- Q29: The applicant is asked to describe what happens in a code review;

- Q30: The applicant is asked what steps they take to ensure the data they work on can be relied upon;

- Q31: The applicant is asked how they collaborate with other developers to deliver features;

- Q32: The applicant is asked how they found out about the job in the UK and whether they were interviewed for the job;

- Q33: The applicant is asked about their prospective weekly working hours and salary;

- Q34: The applicant is asked whether they have applied for any other jobs in the UK;

- Q35: The applicant is asked to confirm their work address in the UK, including post code;

- Q36: The applicant is asked where they will reside in the UK and how they will get to work from their residential address;

- Q37: The applicant is asked about their current job, namely the name of the company they work for, their duties and salary, the company’s size and the names of their line managers, the company’s address;

- Q38: The applicant is asked whether they have any relatives in the sponsoring company;

- Q39: The applicant is asked about any relatives living in the UK, including their full names and residential addresses;

- Q40: The applicant is asked about the highest level of education, where they studies and what grade they achieved.

It is evident that the Home Office goes into great detail to ask the applicant very specific questions about the sector knowledge, and the applicant should look out for tricky questions. If the question is too generic, the applicant should ask the interviewer to narrow it to ensure an accurate answer. If the question does not directly relate to the applicant’s experience, this should be explained to the interviewer rather than trying to come up with an answer which may not be accurate.

We hope that this article will assist prospective applicants and their legal representatives in their preparation for the Home Office interview.

At Chan Neill Solicitors, we provide a wide range of corporate services to prospective sponsors, Licensed sponsors, as well as assistance with visa applications under the work routes, including the preparation for the Home Office interview. Our immigration team has over a decade of practical experience in Immigration Law, and we take on cases with a high degree of complexity. Do not hesitate to reach out for advice or assistance.

This article is provided for general information only. It is not intended to be and cannot be relied upon as legal advice or otherwise. If you would like to discuss any of the matters covered in this article, please contact us using the contact form or email us on reception@cnsolicitors.com