Navigating the Registration Process for Overseas Entities in the UK: Ensuring Compliance and Unlocking Opportunities

The UK continues to attract businesses from all corners of the globe. With its business-friendly infrastructure, environment and history, the UK remains a top destination for international entities seeking to establish a presence. However, for overseas companies looking to operate within the UK, navigating the regulatory landscape can be a daunting task.

One crucial step in this process is the registration of overseas entities, a procedure designed to ensure transparency, accountability, and compliance with UK laws. The Register of Overseas Entities (RoE) was established by the Economic Crime (Transparency and Enforcement) Act 2022 (ECTEA). It is regarded as an important step in dealing with global economic crime and furthering legitimacy within the UK property market.

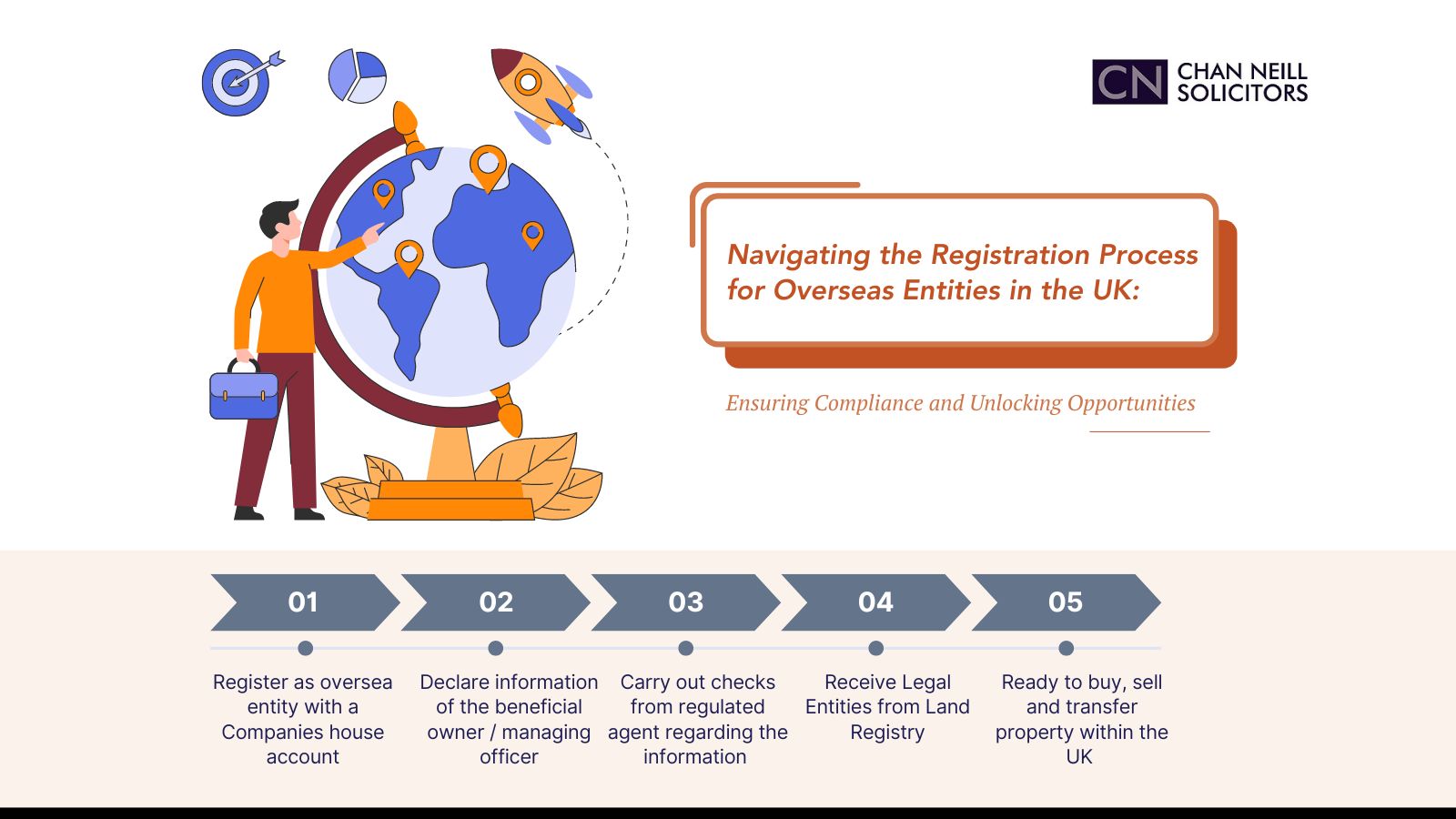

The registration of overseas entities in the UK falls under the control of the Companies House, the government agency responsible for maintaining the official register of companies in the UK. Overseas entities seeking to establish a presence in the UK have historically had to register as an ‘overseas company’ if they plan to carry out business activities within the jurisdiction. On 26 October 2023, the ECTEA received Royal Assent, meaning that overseas entities which own UK property or land must declare information regarding their beneficial owners and/or managing officers.

To apply to register an overseas entity and its beneficial owners, the entity will require a Companies House Account. Detailed information about the overseas entity is required and its beneficial owners and/or managing officers will need to supply information about any relevant trusts, alongside the registration fee. A UK regulated agent based in the UK, often a law firm such as ourselves, must also confirm that they have carried out the requisite verification checks on the information regarding the beneficial owners and/or managing officers. It is therefore quicker and easier for the UK regulated agent to carry out the registration process themselves.

While the registration process may seem complex at first glance, it offers several benefits for overseas entities seeking to establish a foothold in the UK property market.

Legal Recognition: Registration as an overseas company provides legal recognition and legitimacy, enhancing the entity’s credibility and reputation in the UK market.

Access to Markets and Opportunities: Registered overseas entities gain access to the vast UK market and can capitalise on business opportunities, partnerships, and investments within the country.

Enhanced Transparency and Compliance: By registering with Companies House, overseas entities demonstrate their commitment to transparency and compliance with UK laws and regulations, fostering trust among stakeholders and potential partners. If Companies have made an error in applications or have been delayed in registering, a concerted effort to communicate reasoning with Companies House should still be appreciated as a commitment to the transparency and compliance the ECTEA intended.

Protection of Rights and Interests: Registration affords overseas entities legal protections and safeguards their property within the UK, including the ability to sell, buy and lease the properties as well as resolve disputes surrounding the properties through the British legal system.

Once the entity has registered with Companies House, it will be issued with an overseas entity ID number (OEID). When the entity then enters property transactions, this number will be supplied to the Land Registry. The entity will then be able to buy, sell and transfer property within the UK whilst satisfying the regulatory requirements.

In an increasingly interconnected world, the registration of overseas entities in the UK serves as a gateway for foreign companies to new opportunities. While the process may involve complexities and regulatory requirements, it offers numerous benefits for businesses looking to expand their operations into the UK and its property market.

This article is provided for general information only. It is not intended to be and cannot be relied upon as legal advice or otherwise. If you would like to discuss any of the matters covered in this article, please contact us using the contact form or email us on reception@cnsolicitors.com